Rutland FX Currency Converter

Rutland FX is Rated ‘Excellent’ on Google & Trustpilot

Rutland FX Fee & Exchange Rate

Payment Fee: NONE

Exchange Rate: 22.3176 The exchange rate displayed for Rutland FX is an indicative rate. The rate you will receive from us is volume dependent. To get a live quote, please log into your account or contact our sales team.

Cost for R500,000 ZAR

£22,403.83

HSBC Fee & Exchange Rate

Payment Fee: £5

Exchange Rate: 21.6927 The exchange rates shown for this bank are for comparative purposes only. Actual rates may vary for more information about this data please click here

2.8% below the mid-market rate

Cost for R500,000 ZAR

£23,044.20

Save up to £640.38 with Rutland FX

NatWest Fee & Exchange Rate

Payment Fee: £15

Exchange Rate: 21.4249 The exchange rates shown for this bank are for comparative purposes only. Actual rates may vary for more information about this data please click here

4% below the mid-market rate

Cost for R500,000 ZAR

£23,322.32

Save up to £918.49 with Rutland FX

Santander Fee & Exchange Rate

Payment Fee: £25

Exchange Rate: 21.7597 The exchange rates shown for this bank are for comparative purposes only. Actual rates may vary for more information about this data please click here

2.5% below the mid-market rate

Cost for R500,000 ZAR

£22,953.28

Save up to £549.46 with Rutland FX

Lloyds Fee & Exchange Rate

Payment Fee: £9.50

Exchange Rate: 21.5253 The exchange rates shown for this bank are for comparative purposes only. Actual rates may vary for more information about this data please click here

3.55% below the mid-market rate

Cost for R500,000 ZAR

£23,218.94

Save up to £815.11 with Rutland FX

The table above is a currency exchange comparison to illustrate the cost in pounds for buying R500,000 South African Rand with Rutland FX against various high street banks to help you compare exchange rates. For more detailed information about the data shown in this table, please see our comparison information page.

How We Keep Your Money Safe

FCA Regulation

Rutland FX is a UK-based FinTech company incorporated in 2016. Rutland FX is powered by Currencycloud, a Visa subsidiary. Currencycloud is regulated by the Financial Conduct Authority (FCA) as an Electronic Money Institution (EMI) under firm reference number 900199.

Account Security

To secure your account, we implement strong customer authentication in compliance with the Payment Services Regulations 2017. We use Onfido for identity verification and fraud prevention, ensuring the authenticity of government-issued IDs.

Multi-Factor Authentication

Access to your Rutland FX account requires Two-Factor Authentication (2FA) via Authy or SMS. Outbound payments to new payees will also require Two-Factor Authentication (2FA) for added security.

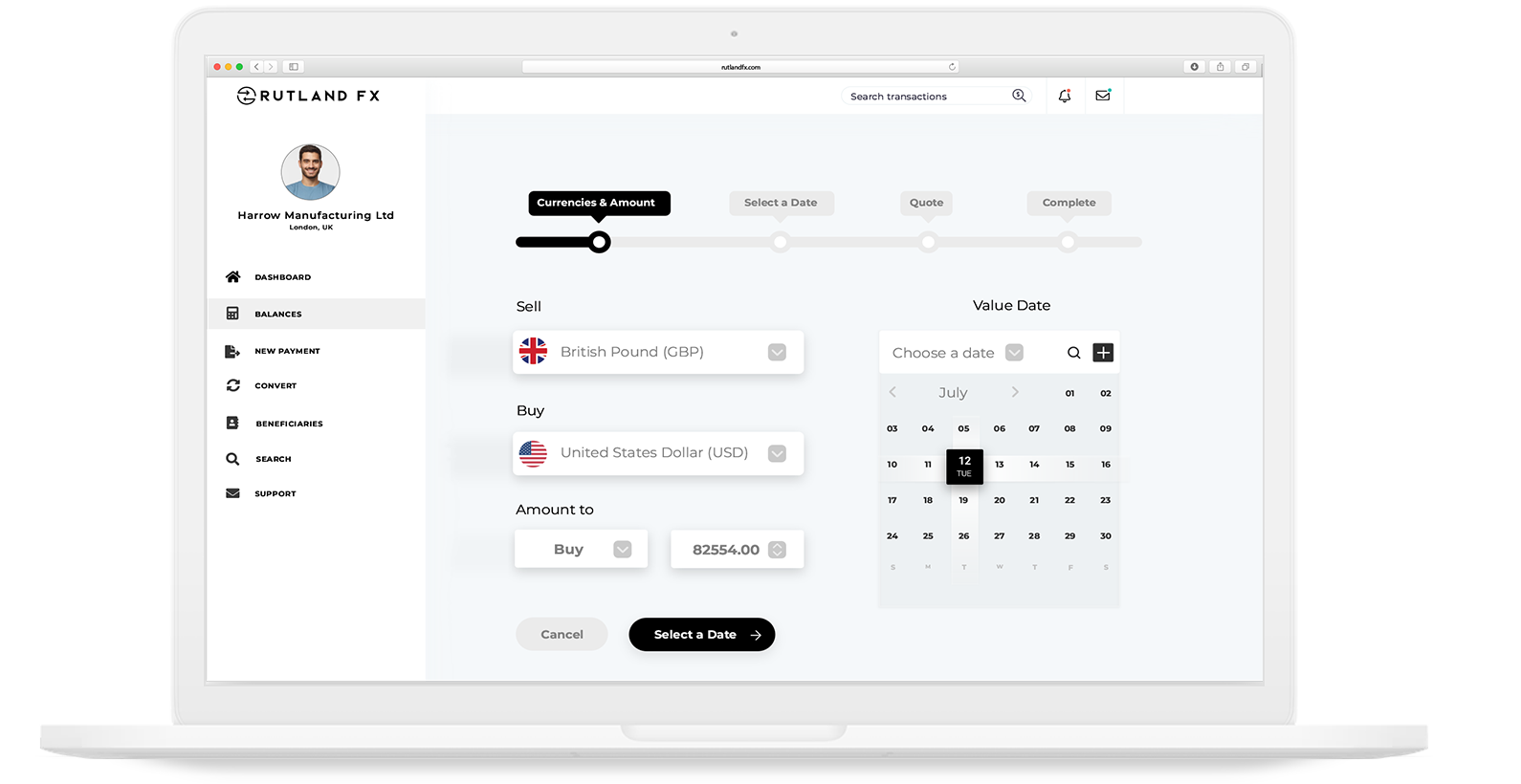

How to Send Money to South Africa with Rutland FX?

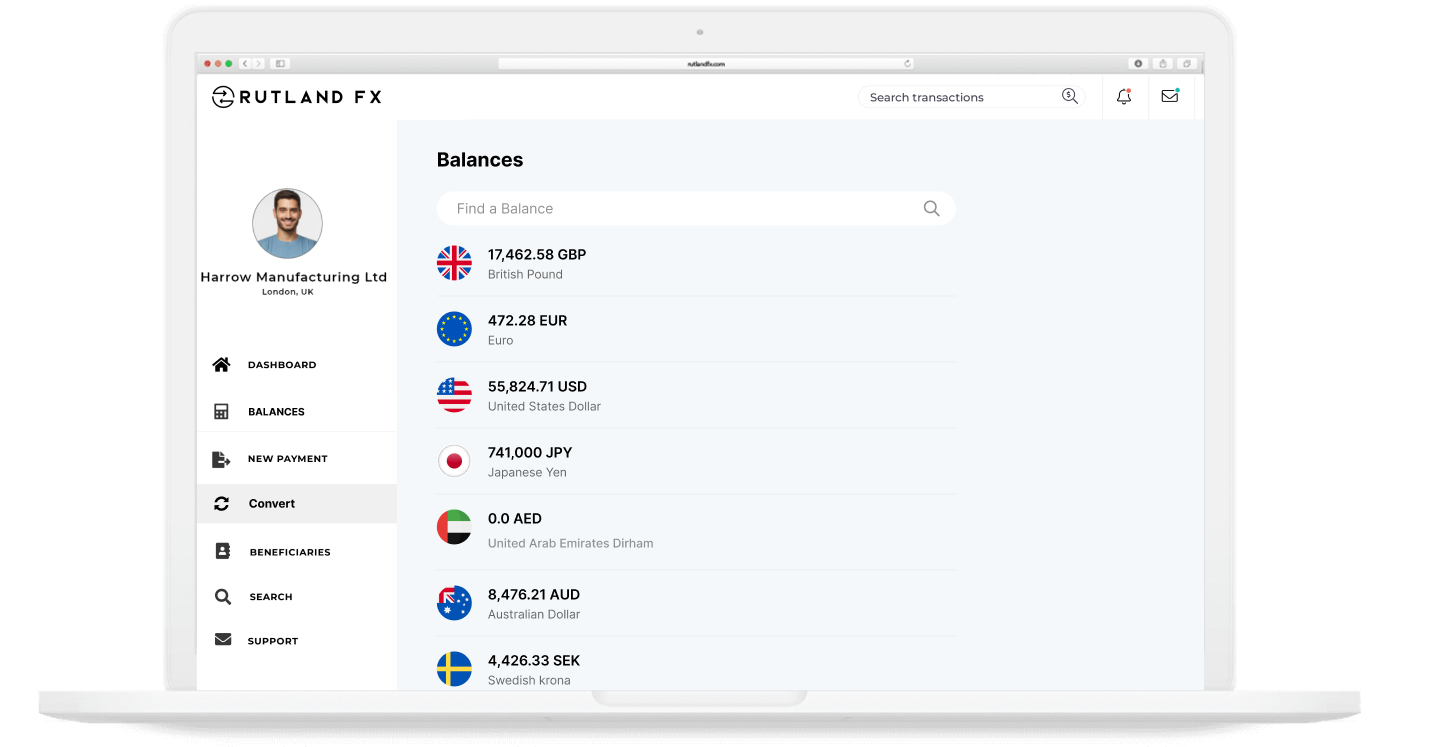

It’s easy to send money to South Africa with Rutland FX. Businesses and individuals can sign up for an account for free, as long as you meet the criteria listed on our application guidelines page. Once you’re all set up, you can make currency conversions to ZAR and money transfers directly on the platform or by speaking to your account executive.

What Details Do I Need for a Transfer to South Africa?

To send money to South Africa in ZAR with Rutland FX, the only available payment rail is SWIFT. For a SWIFT transfer to South Africa in ZAR, you will need:

- SWIFT/BIC Code: This code identifies the recipient’s bank internationally.

- Account Number: The recipient’s unique bank account number.

- Company Name and Address: The name and address of the recipient.

You can easily validate and save these account details on the platform for future use.

What is the Fastest Way to Send Money to South Africa?

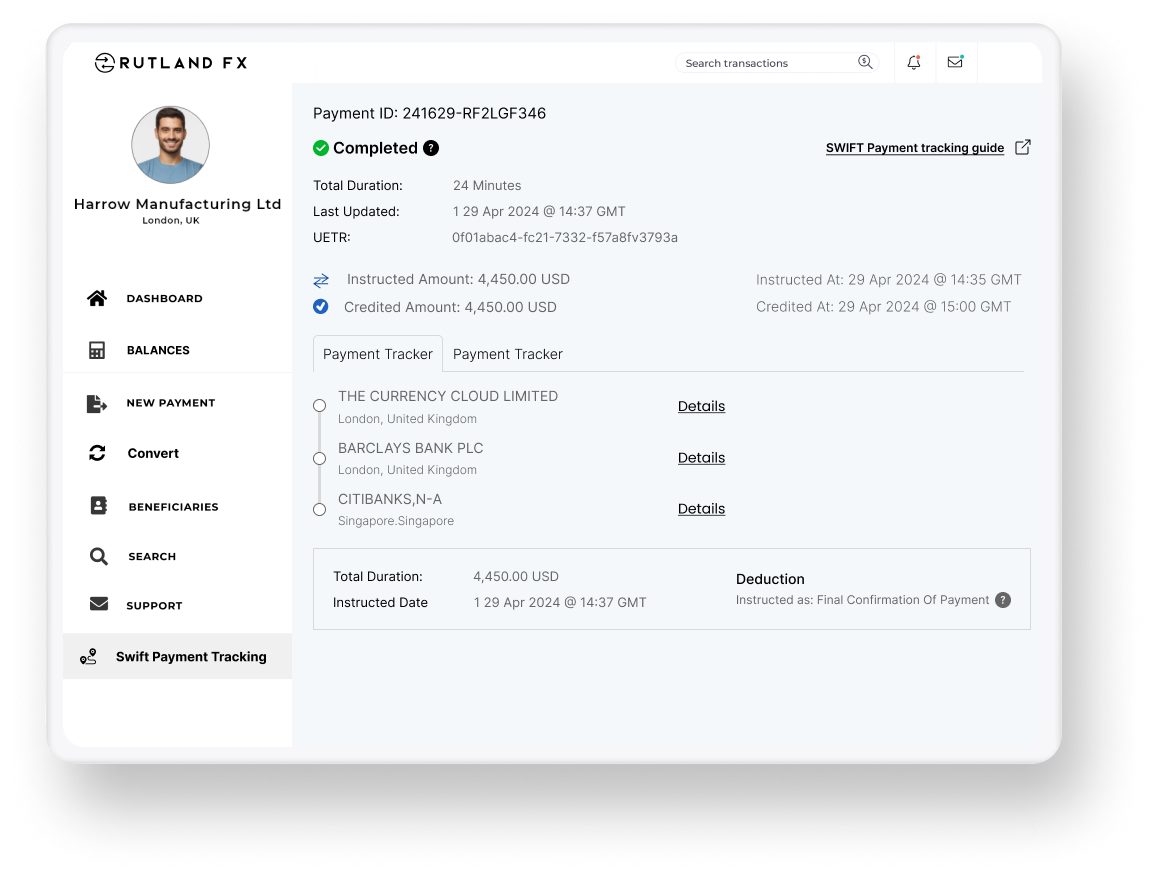

The fastest way to send money to South Africa is via SWIFT GPI. This method is highly efficient, with 40% of payments arriving in less than 5 minutes and most payments arriving within 24 hours. In some cases, you can even make an instant international payment to South Africa in ZAR. SWIFT GPI also provides easy tracking of your payments through the SWIFT network, ensuring transparency for your international bank transfers. You can monitor your payment directly on our platform.

To make a payment via SWIFT GPI with Rutland FX, simply select ‘Priority Payment.’ If SWIFT GPI is available for your transaction, it will be enabled automatically, allowing you to make a quick international money transfer at no additional fee.

How Long Will It Take for the ZAR to Arrive?

The duration of international bank transfers to South Africa depends on the correspondent banks involved. Generally, payments sent to South Africa with Rutland FX in ZAR via SWIFT arrive within a few hours, with almost 100% arriving within 24 hours. In some cases, our SWIFT GPI-enabled transfers can be instant.

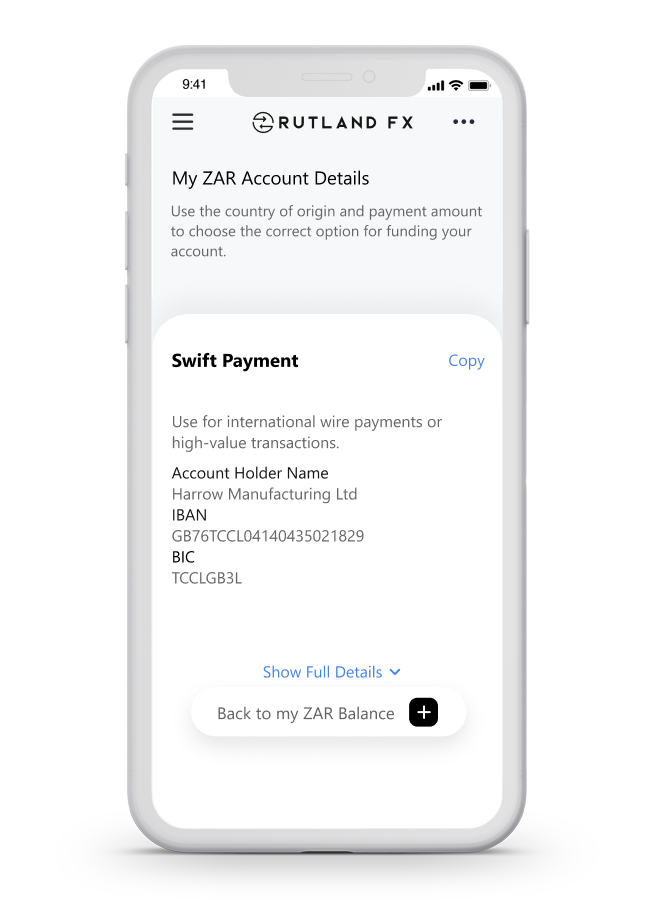

Open a UK-Based ZAR Account

Start Sending Money to South Africa with Rutland FX

Sign Up Online

Tell us about yourself! Are you a business or a private individual? What countries do you plan to send or receive money from, what currencies do you need, and what volumes do you expect to send with Rutland FX?

Onboarding Review

Our dedicated onboarding team will review your application quickly and inform you if we need any additional information, such as an ID or a bank statement. Once that’s sorted, your account will be activated and ready to go!

Send Money Globally

You’re all set! Enjoy transferring money to over 170 countries and receiving funds in over 35 currencies from more than 120 countries, all with no payment fees and competitive exchange rates.

Ready To Get Started With Rutland FX?

Get Started

FAQs: Sending Money to South Africa

What is an IBAN for Payments in ZAR?

When sending money to South Africa, the IBAN (International Bank Account Number) is required. This code helps identify the recipient’s bank and specific branch in South Africa, ensuring the money is directed correctly.

IBAN: Identifies the recipient’s bank within South Africa. An IBAN is a standardized international code that uniquely identifies a specific bank account. For example, an IBAN could be “ZA12345678901234567890”. This number is structured as follows:

- The first 2 characters represent the country code (e.g., “ZA” for South Africa).

- The next 2 digits represent the check digits.

- The remaining characters represent the domestic bank account number.

How are my Funds Protected?

As an Electronic Money Institution (EMI), Currency Cloud is obligated to maintain adequate capital reserves and ensure the proper safeguarding of customer funds. All funds received in relation to electronic money will be safeguarded in tier-one credit institutions such as Barclays Bank PLC. This ensures that in the unlikely event of our insolvency, administrators would reimburse your funds from the safeguarded funds.

Can I Receive Funds from South Africa?

Yes, Rutland FX can provide you with a UK-based ZAR account that supports SWIFT transfers. This is particularly useful if you are selling a property or assets in South Africa and need to repatriate funds at a better exchange rate. However, we can only onboard you as a customer if you are a citizen or have a residence in, or if your business is registered in, one of the supported countries.

Can I Send Money to South Africa Using Other Currencies Besides ZAR?

Yes, you can. For example, it is common for businesses and individuals in South Africa to hold multi-currency accounts. You can send USD to South Africa if the recipient holds a USD account in South Africa that supports SWIFT payments.

Are There Any Limits on the Amount of Money I Can Transfer to South Africa?

There are currently no transfer limits on SWIFT payments to South Africa with Rutland FX. This means you can settle large invoices or move substantial amounts of money with ease using Rutland FX.

How Do I Track the Status of My Transfer to South Africa?

Our ZAR transfers are sent using SWIFT GPI by default, meaning they will be trackable, traceable, and recallable. You can track your payment directly on the platform or by contacting your account executive. You will be able to see the full journey of the transfer along the SWIFT network, detailing how long it took to arrive and any deductions taken by correspondent banks, if any.

How Do I Cancel or Amend a Transfer to South Africa After It Has Been Initiated?

You should always double-check bank details and ensure you want to dispatch a payment before sending funds internationally to avoid delays. However, on some occasions, you may want to cancel a payment. If a payment has been instructed on your account but has not yet been dispatched, you can cancel it on the platform or by contacting support.

If the payment has already been dispatched and the funds have gone to a trusted recipient, the fastest way to get the funds back would be to ask the recipient to send it back to your ZAR account with Rutland FX. If not, we can action a recall on the funds; however, this is not guaranteed and may require consent from the recipient if the funds have credited their account.

How Can I Contact Rutland FX Support?

Rutland FX offers live support via telephone and email. Email support is available 24 hours a day, ensuring you can get assistance at any time. Telephone support is available during UK business hours, from 8:30 AM to 5:30 PM.