AED to GBP Exchange Rate Today: Live Chart and Updates

Waiting for a better rate? subscribe to our updates. We regularly send the latest market news and exchange rates to keep you informed.

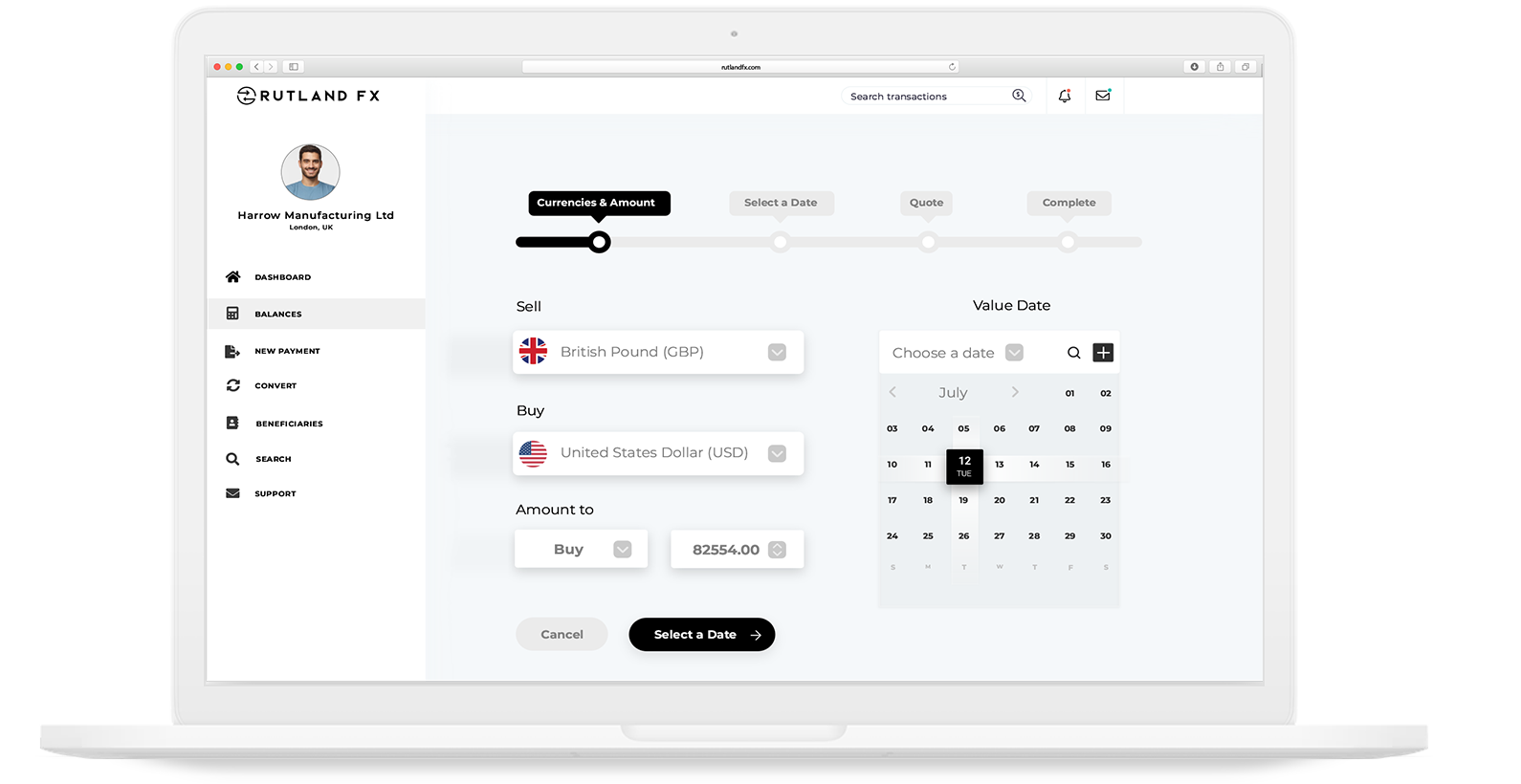

How to Convert AED to GBP with Rutland FX

How We Keep Your Money Safe

FCA Regulation

Rutland FX is a UK-based FinTech company incorporated in 2016. Rutland FX is powered by Currencycloud, a Visa subsidiary. Currencycloud is regulated by the Financial Conduct Authority (FCA) as an Electronic Money Institution (EMI) under firm reference number 900199.

Account Security

To secure your account, we implement strong customer authentication in compliance with the Payment Services Regulations 2017. We use Onfido for identity verification and fraud prevention, ensuring the authenticity of government-issued IDs.

Multi-Factor Authentication

Access to your Rutland FX account requires Two-Factor Authentication (2FA) via Authy or SMS. Outbound payments to new payees will also require Two-Factor Authentication (2FA) for added security.

AED to GBP Currency Conversion Table

Stay up to date with the latest AED to GBP currency conversion rates. This table is updated regularly, making it easy to see how much different amounts of currency can get you. Whether you are planning a trip, making international purchases, or managing investments, you can use this table to get an accurate and current idea of the mid-market exchange rate.

GBP to AED |

AED to GBP |

|---|---|

| Loading... | Loading... |

| Loading... | Loading... |

| Loading... | Loading... |

| Loading... | Loading... |

| Loading... | Loading... |

| Loading... | Loading... |

| Loading... | Loading... |

| Loading... | Loading... |

| Loading... | Loading... |

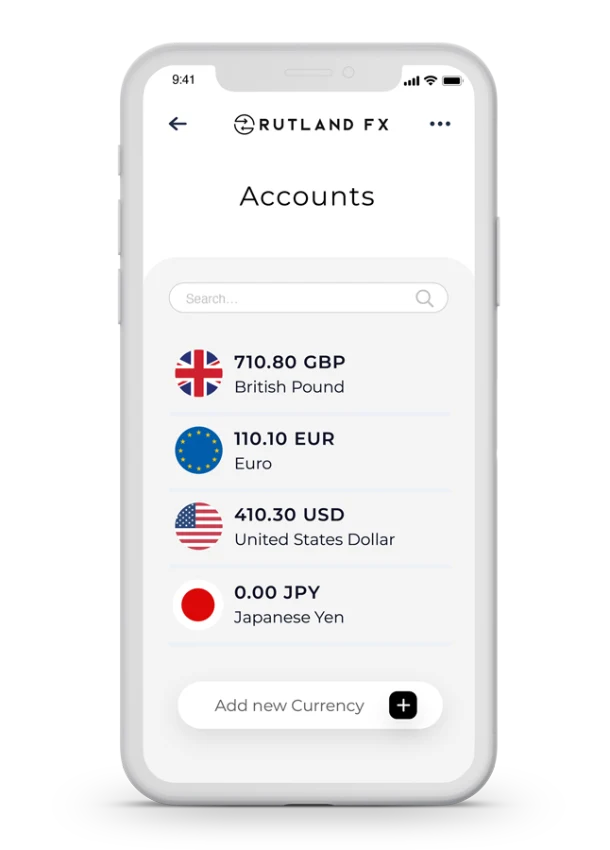

Repatriate Funds from the UAE to the UK with Rutland FX

Sign Up Online

Tell us about yourself! Are you a business or a private individual? What countries do you plan to send or receive money from, what currencies do you need, and what volumes do you expect to send with Rutland FX?

Onboarding Review

Our dedicated onboarding team will review your application quickly and inform you if we need any additional information, such as an ID or a bank statement. Once that’s sorted, your account will be activated and ready to go!

Send Money Globally

You’re all set! Enjoy transferring money to over 170 countries and receiving funds in over 35 currencies from more than 120 countries, all with no payment fees and competitive exchange rates.

Rutland FX is Rated ‘Excellent’ on Google & Trustpilot

Still Not Sure? Speak with Our Sales Team

Request a callback