Rutland FX Currency Converter

Rutland FX is Rated ‘Excellent’ on Google & Trustpilot

Rutland FX Fee & Exchange Rate

Payment Fee: NONE

Exchange Rate: 1.8500 The exchange rate displayed for Rutland FX is an indicative rate. The rate you will receive from us is volume dependent. To get a live quote, please log into your account or contact our sales team.

Cost for $35,000 CAD

£18,918.71

HSBC Fee & Exchange Rate

Payment Fee: £5

Exchange Rate: 1.7982 The exchange rates shown for this bank are for comparative purposes only. Actual rates may vary for more information about this data please click here

2.8% below the mid-market rate

Cost for $35,000 CAD

£19,458.70

Save up to £539.98 with Rutland FX

NatWest Fee & Exchange Rate

Payment Fee: £15

Exchange Rate: 1.7760 The exchange rates shown for this bank are for comparative purposes only. Actual rates may vary for more information about this data please click here

4% below the mid-market rate

Cost for $35,000 CAD

£19,691.99

Save up to £773.28 with Rutland FX

Santander Fee & Exchange Rate

Payment Fee: £25

Exchange Rate: 1.8038 The exchange rates shown for this bank are for comparative purposes only. Actual rates may vary for more information about this data please click here

2.5% below the mid-market rate

Cost for $35,000 CAD

£19,378.81

Save up to £460.10 with Rutland FX

Lloyds Fee & Exchange Rate

Payment Fee: £9.50

Exchange Rate: 1.7843 The exchange rates shown for this bank are for comparative purposes only. Actual rates may vary for more information about this data please click here

3.55% below the mid-market rate

Cost for $35,000 CAD

£19,605.55

Save up to £686.83 with Rutland FX

The table above is a currency exchange comparison to illustrate the cost in pounds for buying 35,000 Canadian Dollars with Rutland FX against various high street banks to help you compare exchange rates. For more detailed information about the data shown in this table, please see our comparison information page.

How We Keep Your Money Safe

FCA Regulation

Rutland FX is a UK-based FinTech company incorporated in 2016. Rutland FX is powered by Currencycloud, a Visa subsidiary. Currencycloud is regulated by the Financial Conduct Authority (FCA) as an Electronic Money Institution (EMI) under firm reference number 900199.

Account Security

To secure your account, we implement strong customer authentication in compliance with the Payment Services Regulations 2017. We use Onfido for identity verification and fraud prevention, ensuring the authenticity of government-issued IDs.

Multi-Factor Authentication

Access to your Rutland FX account requires Two-Factor Authentication (2FA) via Authy or SMS. Outbound payments to new payees will also require Two-Factor Authentication (2FA) for added security.

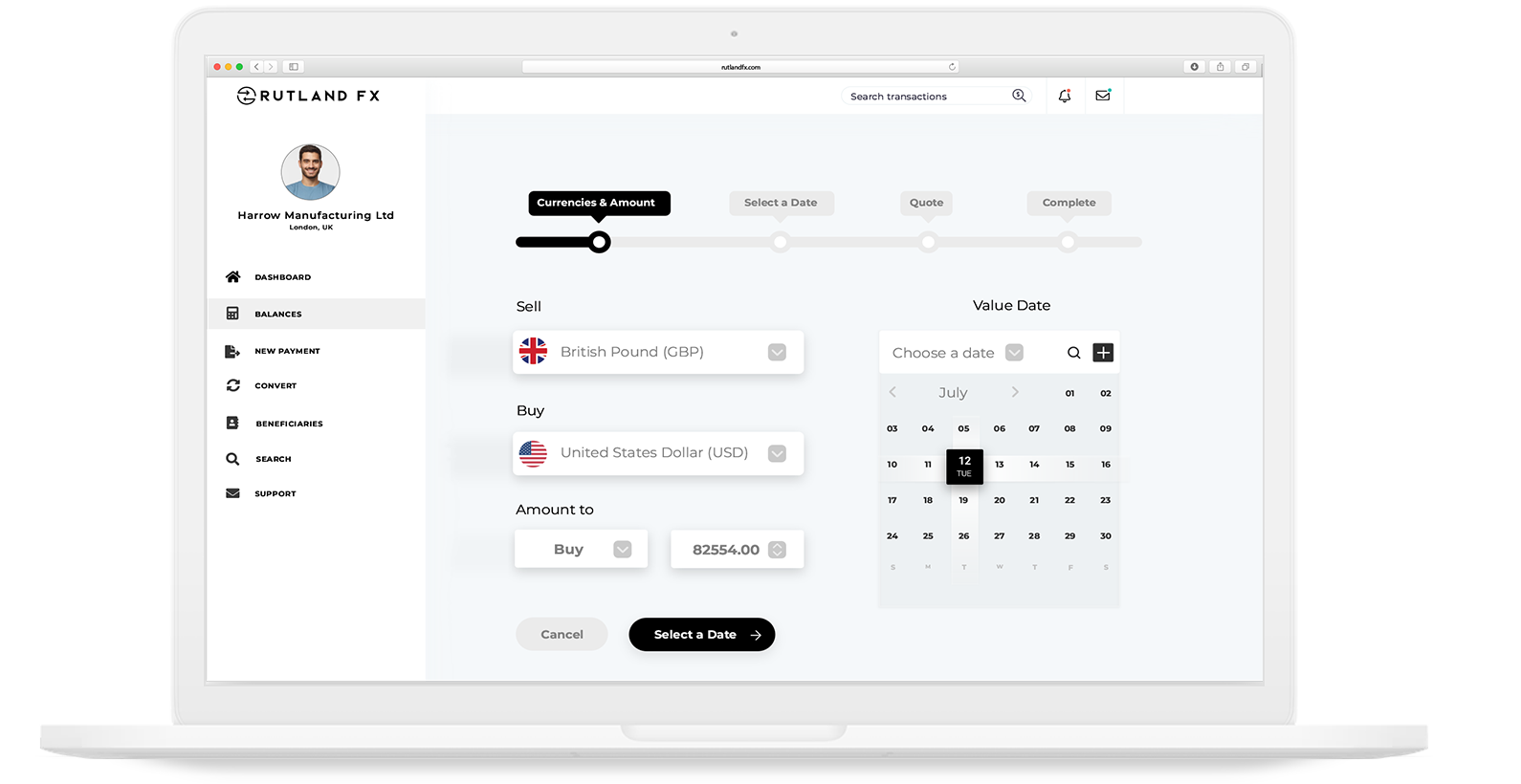

How to Send Money to Canada with Rutland FX?

It’s easy to send money to Canada with Rutland FX. Businesses and individuals can sign up for an account for free, as long as you meet the criteria listed on our application guidelines page. Once you’re all set up, you can make currency conversions and money transfers directly on the platform or by speaking to your account executive.

What Details Do I Need for a Transfer to Canada?

To send money to Canada with Rutland FX, you have two options: Electronic Funds Transfer (EFT) or SWIFT.

For EFT, you will need:

- Bank Code: This code identifies the recipient’s bank.

- Branch Code: A code used to identify the specific branch of the bank.

- Account Number: The recipient’s unique bank account number at the specified branch.

For SWIFT, you will need:

- Account Number: The recipient’s unique bank account number.

- SWIFT/BIC Code: This code identifies the recipient’s bank internationally.

For both payment methods, we also require the recipient’s name and address. You can easily validate and save these account details on the platform for future use.

What is the Fastest Way to Send Money to Canada?

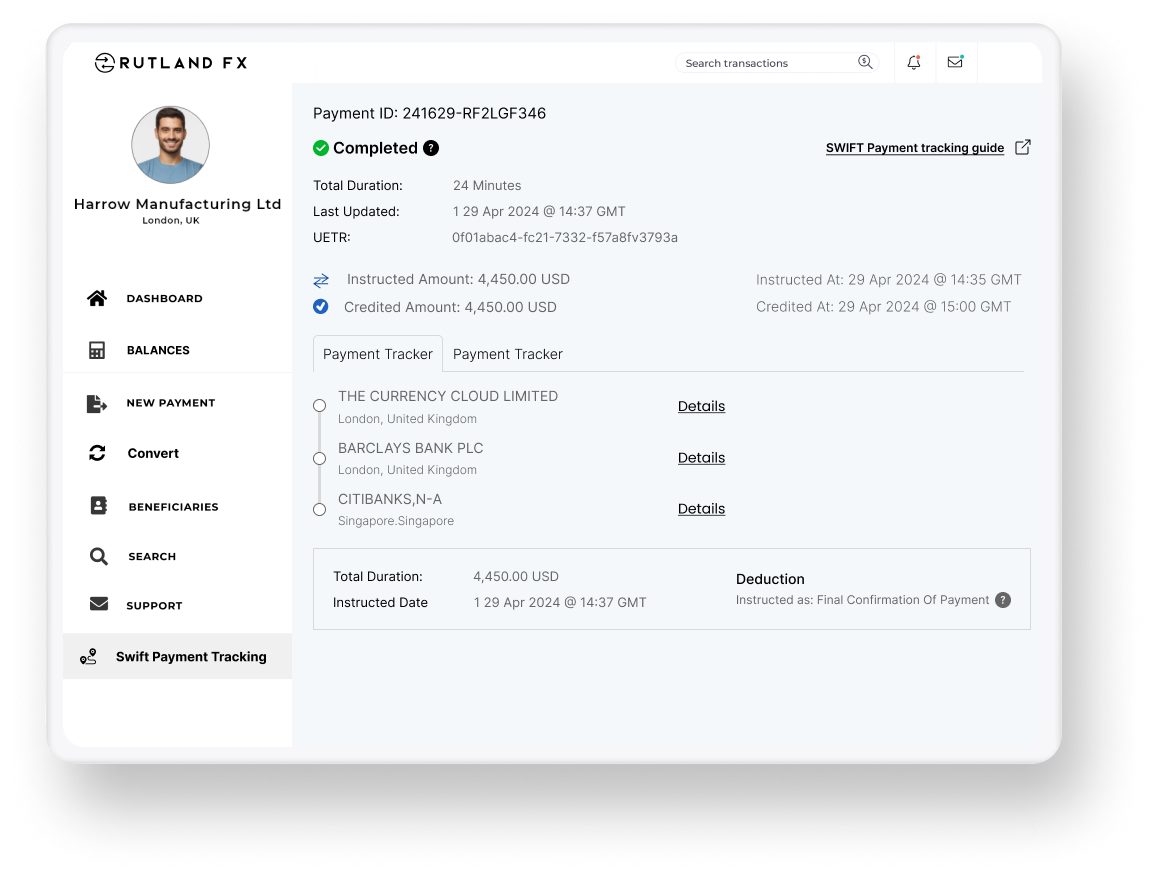

The fastest way to send money to Canada is via SWIFT GPI. This method is highly efficient, with 40% of payments arriving in less than 5 minutes and most payments arriving within 24 hours. In some cases, you can even make an instant international payment to Canada in CAD. SWIFT GPI also provides easy tracking of your payments through the SWIFT network, ensuring transparency for your international bank transfers. You can monitor your payment directly on our platform.

To make a payment via SWIFT GPI with Rutland FX, simply select “Priority Payment.” If SWIFT GPI is available for your transaction, it will be enabled automatically, allowing you to make a quick international money transfer at no additional fee.

How Long Will It Take for the CAD to Arrive?

The duration of international bank transfers to Canada depends on the payment rail and correspondent banks involved. Generally, payments sent to Canada with Rutland FX in CAD arrive within a few hours, with almost 100% arriving within 24 hours.

Using our local payment route, EFT, may take longer, usually around 1-3 days. However, SWIFT GPI transfers can be instant in some cases, with the majority arriving within a few hours. The receiving bank’s processing times can also affect how quickly the funds become available.

If you need the funds to arrive quickly, it’s best to select “Priority Payment” on the platform. However, if you’re not in a hurry, you can choose “Regular Payment.”

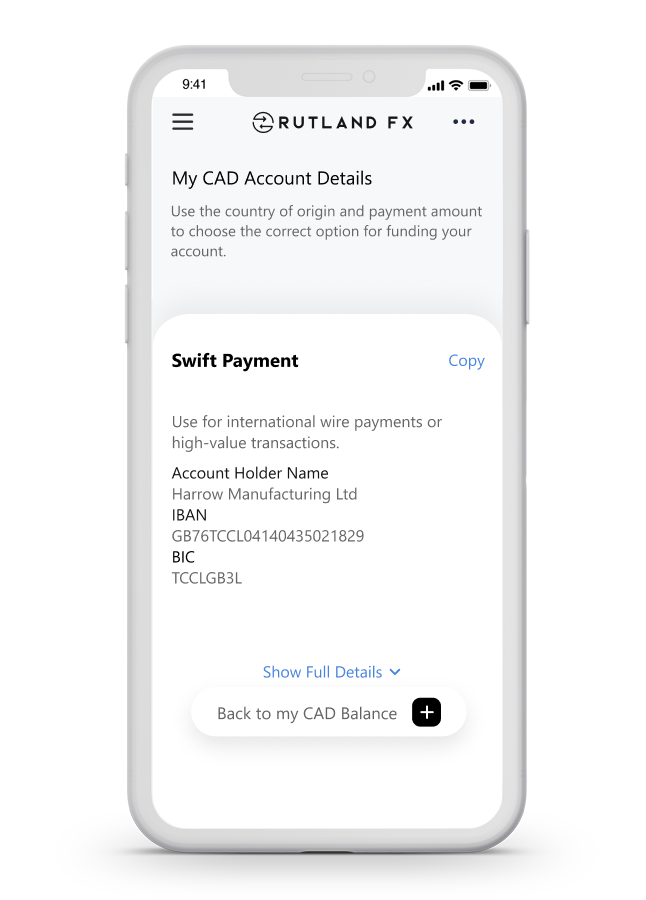

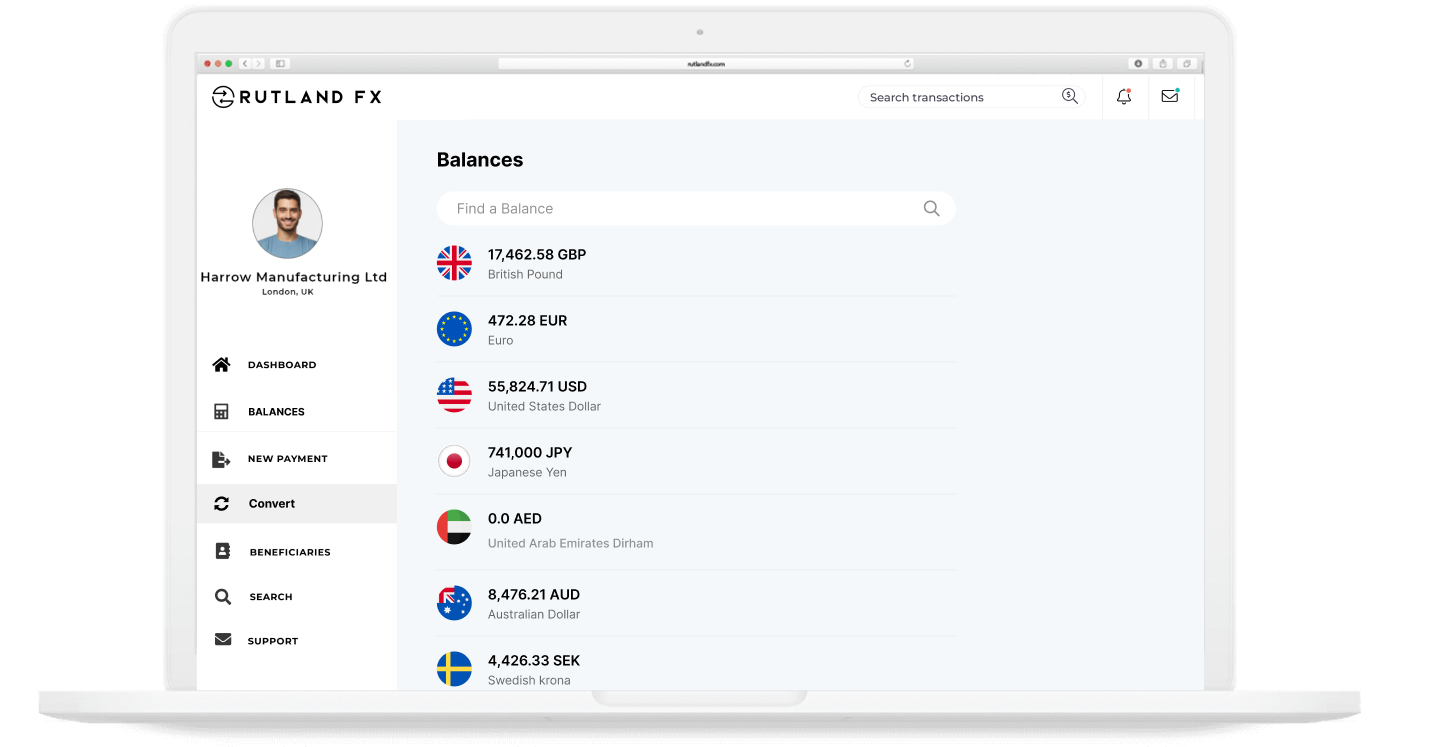

Open a UK-Based CAD Account

Rutland FX offers UK-based CAD multi-currency accounts in your name or your business’s name, designed to simplify managing your CAD transactions. Whether you’re a business handling Australian transactions or an individual with financial interests in Australia, our accounts provide a convenient solution. You can hold and manage CAD balances, simplifying cash management and reconciliation. Receiving funds from Canada into your Rutland FX account is easy, and you can convert them back to GBP as needed. For outbound payments, you can hold CAD in your account until you’re ready to send it out.

Start Sending Money to Canada with Rutland FX

Sign Up Online

Tell us about yourself! Are you a business or a private individual? What countries do you plan to send or receive money from, what currencies do you need, and what volumes do you expect to send with Rutland FX?

Onboarding Review

Our dedicated onboarding team will review your application quickly and inform you if we need any additional information, such as an ID or a bank statement. Once that’s sorted, your account will be activated and ready to go!

Send Money Globally

You’re all set! Enjoy transferring money to over 170 countries and receiving funds in over 35 currencies from more than 120 countries, all with no payment fees and competitive exchange rates.

Ready To Get Started With Rutland FX?

Get Started

FAQs: Sending Money to Canada

What is a Bank Code and Branch Code for Local Payments in CAD?

When sending money to Canada via Electronic Funds Transfer (EFT), the Bank Code and Branch Code are required. These codes help identify the recipient’s bank and specific branch in Canada, ensuring the money is directed correctly. The Bank Code and Branch Code are structured as follows:

- Bank Code: Identifies the recipient’s bank.

- Branch Code: Identifies the specific branch of the bank.

When you combine the Bank Code and the Branch Code, you create the routing number, which can be used to process international payments.

Example of a Combined Routing Number:

- Bank Code: 003 (Royal Bank of Canada)

- Branch Code: 00002 (RBC Toronto Main Branch)

- Combined Routing Number: 00300002

This combined routing number ensures that the funds are directed to the correct bank and branch in Canada.

What is Electronic Funds Transfer (EFT)?

Rutland FX offers EFT as a local payment route. It’s an alternative to SWIFT for cases where the recipient does not support SWIFT payments or when the payment is dispatched as a non-priority payment. EFT is a payment system used in Canada for processing domestic payments. Managed and operated by Payments Canada, it allows businesses and individuals to transfer funds directly to Canadian bank accounts in CAD. This method is especially beneficial for those making regular payments to Canada, such as for business transactions, personal remittances, or paying for services. However, the maximum EFT CAD payment is CAD 200,000. If you need to send more, use SWIFT.

Although EFT is primarily used within Canada, payment service providers can utilise EFT when they have a relationship with a bank in Canada or a third party to facilitate the domestic leg of the transfer.

What is the Difference Between Local and SWIFT CAD Payments?

The SWIFT network is the primary and default method Rutland FX uses for facilitating international payments because it offers speed, traceability, and recallability. With SWIFT, we can track payments along their journey, monitor their delivery status, and there are no limits on the amount you can transfer. However, in some instances, you may opt to send money to Canada via a local payment route. The current supported route for local payments is called EFT. It’s important to note that the cut-off time for SWIFT is later than the cut-off time for EFT, providing more flexibility and a longer window to initiate SWIFT payments compared to EFT payments. Additionally, EFT may be slower than SWIFT and is not traceable or recallable like SWIFT.

How are my Funds Protected?

As an Electronic Money Institution (EMI), Currency Cloud is obligated to maintain adequate capital reserves and ensure the proper safeguarding of customer funds. All funds received in relation to electronic money will be safeguarded in tier-one credit institutions such as Barclays Bank PLC. This ensures that in the unlikely event of our insolvency, administrators would reimburse your funds from the safeguarded funds.

Can I Receive Funds from Canada?

Yes, Rutland FX can provide you with a UK-based CAD account that supports SWIFT transfers. This is particularly useful if you are selling a property or assets in Canada and need to repatriate funds at a better exchange rate. However, we can only onboard you as a customer if you are a citizen or have a residence in, or if your business is registered in, one of the supported countries.

Can I Send Money to Canada Using Other Currencies Besides CAD?

Yes, you can. For example, it is common for businesses and individuals in Canada to hold multi-currency accounts. You can send USD to Canada if the recipient holds a USD account in Canada that supports SWIFT payments.

Are There Any Limits on the Amount of Money I Can Transfer to Canada?

There are currently no transfer limits on SWIFT payments to Canada with Rutland FX. However, the maximum EFT CAD payment is CAD 200,000. If you need to send more, you will need to use SWIFT. This means you can settle large invoices or move substantial amounts of money with ease using Rutland FX.

How Do I Track the Status of My Transfer to Canada?

If your transfer is sent as a priority payment and is SWIFT GPI enabled, you will be able to track the transfer directly on the platform. Alternatively, you can contact your account executive for assistance. You will be able to see the full journey of the transfer along the SWIFT network, detailing how long it took to arrive and any deductions taken by correspondent banks, if any.

How Do I Cancel or Amend a Transfer to Canada After It Has Been Initiated?

You should always double-check bank details and ensure you want to dispatch a payment before sending funds internationally to avoid delays. However, on some occasions, you may want to cancel a payment. If a payment has been instructed on your account but has not yet been dispatched, you can cancel it on the platform or by contacting support.

If the payment has already been dispatched and the funds have gone to a trusted recipient, the fastest way to get the funds back would be to ask the recipient to send it back to your CAD account with Rutland FX. If not, we can action a recall on the funds; however, this is not guaranteed and may require consent from the recipient if the funds have credited their account.

For EFT payments, once it’s dispatched, it is not possible to cancel or recall the payment.

How Can I Contact Rutland FX Support?

Rutland FX offers live support via telephone and email. Email support is available 24 hours a day, ensuring you can get assistance at any time. Telephone support is available during UK business hours, from 8:30 AM to 5:30 PM.