Rutland FX Currency Converter

Rutland FX is Rated ‘Excellent’ on Google & Trustpilot

Rutland FX Fee & Exchange Rate

Payment Fee: NONE

Exchange Rate: 1.8889 The exchange rate displayed for Rutland FX is an indicative rate. The rate you will receive from us is volume dependent. To get a live quote, please log into your account or contact our sales team.

Cost for $40,000 AUD

£21,176.83

HSBC Fee & Exchange Rate

Payment Fee: £5

Exchange Rate: 1.8360 The exchange rates shown for this bank are for comparative purposes only. Actual rates may vary for more information about this data please click here

2.8% below the mid-market rate

Cost for $40,000 AUD

£21,781.86

Save up to £605.03 with Rutland FX

NatWest Fee & Exchange Rate

Payment Fee: £15

Exchange Rate: 1.8133 The exchange rates shown for this bank are for comparative purposes only. Actual rates may vary for more information about this data please click here

4% below the mid-market rate

Cost for $40,000 AUD

£22,044.20

Save up to £867.37 with Rutland FX

Santander Fee & Exchange Rate

Payment Fee: £25

Exchange Rate: 1.8416 The exchange rates shown for this bank are for comparative purposes only. Actual rates may vary for more information about this data please click here

2.5% below the mid-market rate

Cost for $40,000 AUD

£21,694.82

Save up to £518.00 with Rutland FX

Lloyds Fee & Exchange Rate

Payment Fee: £9.50

Exchange Rate: 1.8218 The exchange rates shown for this bank are for comparative purposes only. Actual rates may vary for more information about this data please click here

3.55% below the mid-market rate

Cost for $40,000 AUD

£21,946.78

Save up to £769.95 with Rutland FX

The table above is a currency exchange comparison to illustrate the cost in pounds for buying 40,000 Australian Dollars with Rutland FX against various high street banks to help you compare exchange rates. For more detailed information about the data shown in this table, please see our comparison information page.

How We Keep Your Money Safe

FCA Regulation

Rutland FX is a UK-based FinTech company incorporated in 2016. Rutland FX is powered by Currencycloud, a Visa subsidiary. Currencycloud is regulated by the Financial Conduct Authority (FCA) as an Electronic Money Institution (EMI) under firm reference number 900199.

Account Security

To secure your account, we implement strong customer authentication in compliance with the Payment Services Regulations 2017. We use Onfido for identity verification and fraud prevention, ensuring the authenticity of government-issued IDs.

Multi-Factor Authentication

Access to your Rutland FX account requires Two-Factor Authentication (2FA) via Authy or SMS. Outbound payments to new payees will also require Two-Factor Authentication (2FA) for added security.

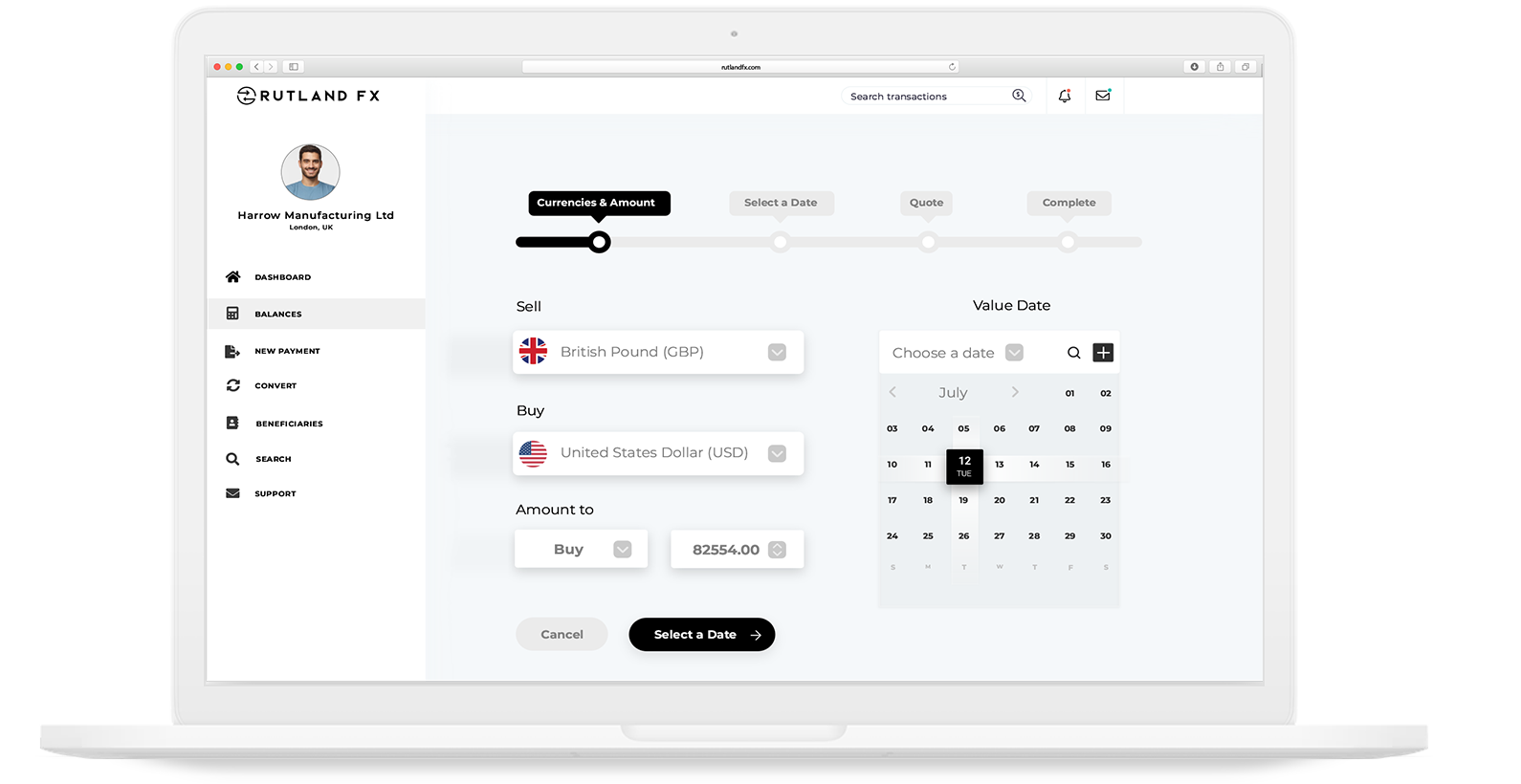

How to Send Money to Australia with Rutland FX?

It’s easy to send money to Australia with Rutland FX. Businesses and individuals can sign up for an account for free, as long as you meet the criteria listed on our application guidelines page. Once you’re all set up, you can make currency conversions and money transfers directly on the platform or by speaking to your account executive.

What Details Do I Need for a Transfer to Australia?

To send money to Australia with Rutland FX, you have two options: Direct Entry (a local payment method) or SWIFT.

For Direct Entry, you will need:

- BSB Code: A six-digit number used to identify individual bank branches in Australia.

- Account Number: The recipient’s unique bank account number at the specified branch.

For SWIFT, you will need:

- Account Number: The recipient’s unique bank account number.

- SWIFT/BIC Code: This code identifies the recipient’s bank internationally.

For both payment methods, we also require the recipient’s name and address. You can easily validate and save these account details on the platform for future use.

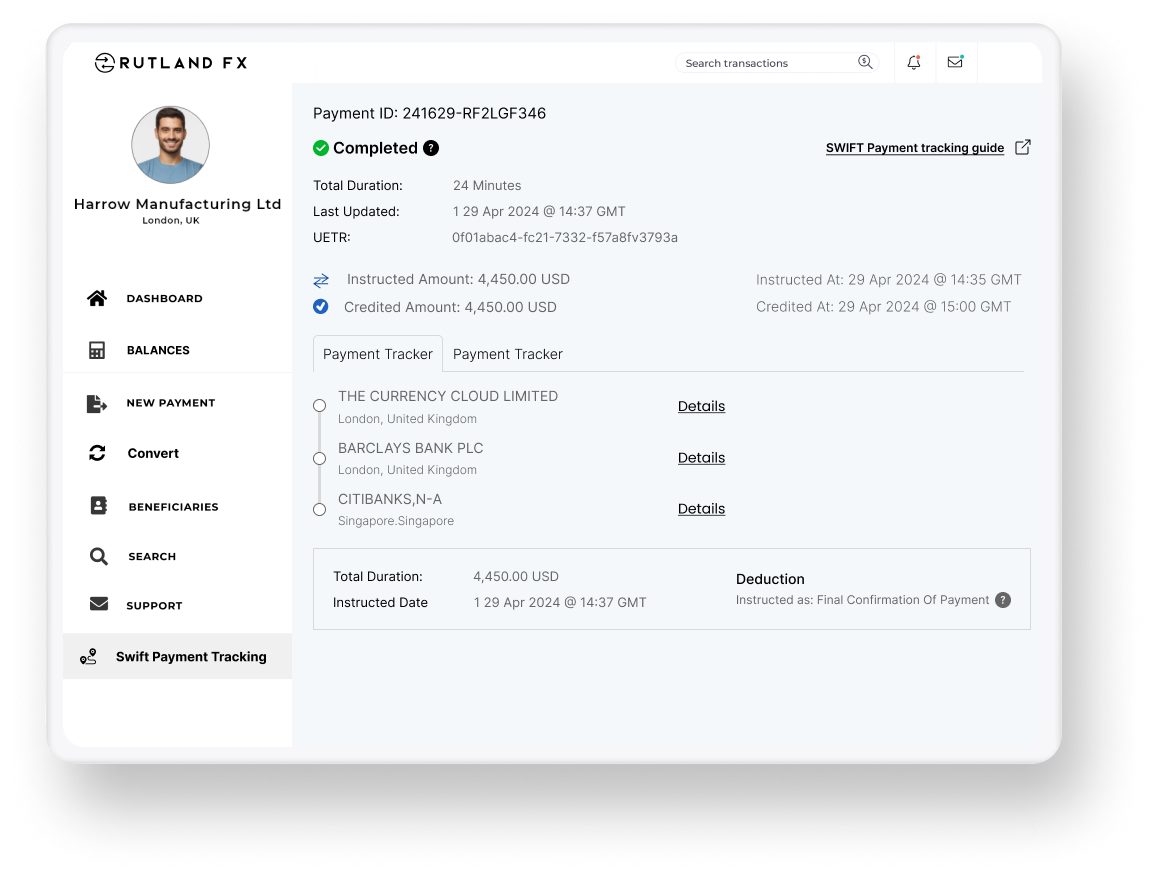

What is the Fastest Way to Send Money to Australia?

The fastest way to send money to Australia is via SWIFT GPI. This method is highly efficient, with 40% of payments arriving in less than 5 minutes and most payments arriving within 24 hours. In some cases, you can even make an instant international payment to Australia in AUD. SWIFT GPI also provides easy tracking of your payments through the SWIFT network, ensuring transparency for your international bank transfers. You can monitor your payment directly on our platform.

To make a payment via SWIFT GPI with Rutland FX, simply select “Priority Payment.” If SWIFT GPI is available for your transaction, it will be enabled automatically, allowing you to make a quick international money transfer at no additional fee.

How Long Will It Take for the AUD to Arrive?

The duration of international bank transfers to Australia depends on the payment rail and correspondent banks involved. Generally, payments sent to Australia with Rutland FX in AUD arrive within a few hours, with almost 100% arriving within 24 hours.

Using our local payment route, Direct Entry, may take longer, usually around 1-3 days. However, SWIFT GPI transfers can be instant in some cases, with the majority arriving within a few hours. The receiving bank’s processing times can also affect how quickly the funds become available.

If you need the funds to arrive quickly, it’s best to select “Priority Payment” on the platform. However, if you’re not in a hurry, you can choose “Regular Payment.”

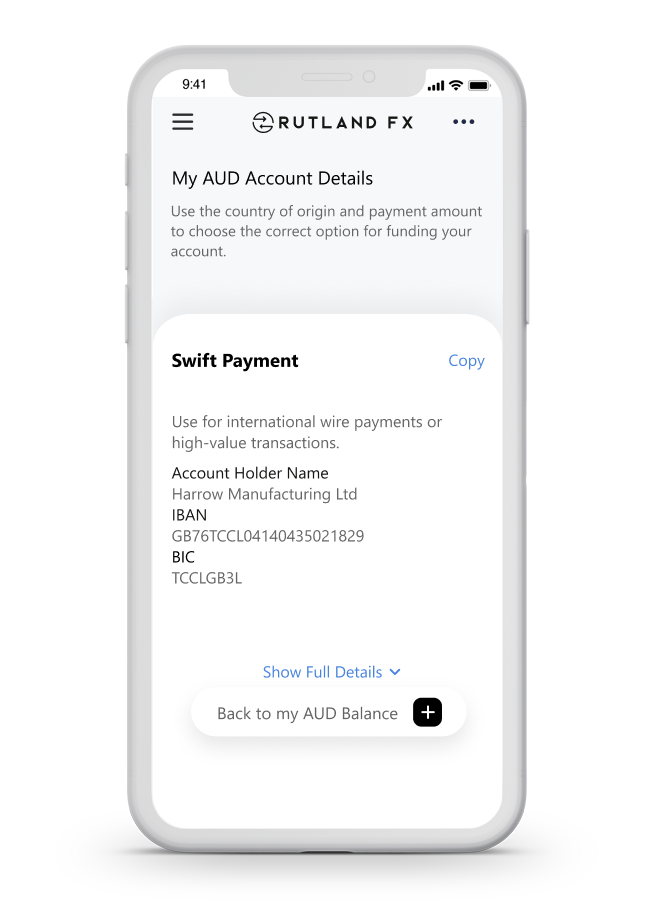

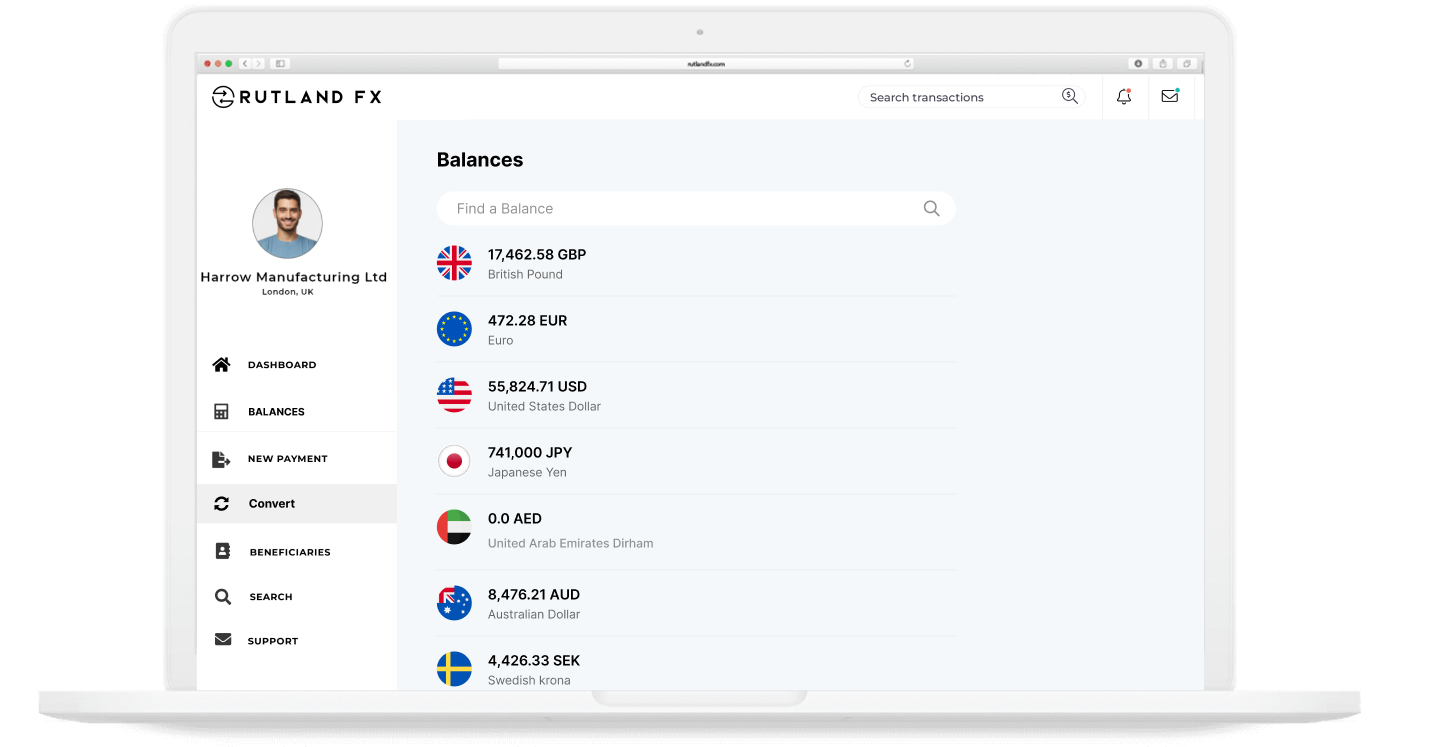

Open a UK-Based AUD Account

Rutland FX offers UK-based AUD multi-currency accounts in your name or your business’s name, designed to simplify managing your AUD transactions. Whether you’re a business handling Australian transactions or an individual with financial interests in Australia, our accounts provide a convenient solution. You can hold and manage AUD balances, simplifying cash management and reconciliation. Receiving funds from Australia into your Rutland FX account is easy, and you can convert them back to GBP as needed. For outbound payments, you can hold AUD in your account until you’re ready to send it out.

Start Sending Money to Australia with Rutland FX

Sign Up Online

Tell us about yourself! Are you a business or a private individual? What countries do you plan to send or receive money from, what currencies do you need, and what volumes do you expect to send with Rutland FX?

Onboarding Review

Our dedicated onboarding team will review your application quickly and inform you if we need any additional information, such as an ID or a bank statement. Once that’s sorted, your account will be activated and ready to go!

Send Money Globally

You’re all set! Enjoy transferring money to over 170 countries and receiving funds in over 35 currencies from more than 120 countries, all with no payment fees and competitive exchange rates.

Ready To Get Started With Rutland FX?

Get Started

FAQs: Sending Money to Australia

What is a BSB Code for Local Payments in AUD?

The Bank State Branch (BSB) code is required when sending money to Australia via Direct Entry. The BSB code is a six-digit number that helps identify the recipient’s bank and branch in Australia, ensuring the money is directed to the correct bank branch. The BSB code is structured as follows:

- The first two digits represent the bank.

- The third digit represents the state where the branch is located.

- The last three digits represent the specific branch.

For example, a BSB code of 062-001 identifies a branch of the Commonwealth Bank of Australia in New South Wales. This ensures that the funds are routed accurately within Australia.

What is Direct Entry Transfer?

Rutland FX offers Direct Entry as a local payment route. It’s an alternative to SWIFT for cases where the recipient does not support SWIFT payments or when the payment is dispatched as a non-priority payment. Direct Entry is a payment system used in Australia for processing domestic payments. Managed and operated by the Australian Payments Network (AusPayNet), it allows businesses and individuals to transfer funds directly to Australian bank accounts in AUD. This method is especially beneficial for those making regular payments to Australia, such as for business transactions, personal remittances, or paying for services.

Although Direct Entry is primarily used within Australia, payment service providers can utilize Direct Entry when they have a relationship with a bank in Australia or a third party to facilitate the domestic leg of the transfer.

What is the Difference Between Local and SWIFT AUD Payments?

The SWIFT network is the primary and default method Rutland FX uses for facilitating international payments because it offers speed, traceability, and recallability. With SWIFT, we can track payments along their journey, monitor their delivery status, and there are no limits on the amount you can transfer. However, in some instances, you may opt to send money to Australia from the UK via a local payment route. The current supported route for local payments is called Direct Entry. It’s important to note that the cut-off time for SWIFT is later than the cut-off time for Direct Entry, providing more flexibility and a longer window to initiate SWIFT payments compared to Direct Entry payments. Additionally, Direct Entry may be slower than SWIFT and is not traceable or recallable like SWIFT.