Rutland FX Currency Converter

Rutland FX is Rated ‘Excellent’ on Google & Trustpilot

Rutland FX Fee & Exchange Rate

Payment Fee: NONE

Exchange Rate: 122.2953 The exchange rate displayed for Rutland FX is an indicative rate. The rate you will receive from us is volume dependent. To get a live quote, please log into your account or contact our sales team.

Cost for ₹2,000,000 INR

£16,353.86

HSBC Fee & Exchange Rate

Payment Fee: £5

Exchange Rate: 118.8710 The exchange rates shown for this bank are for comparative purposes only. Actual rates may vary for more information about this data please click here

2.8% below the mid-market rate

Cost for ₹2,000,000 INR

£16,819.96

Save up to £466.10 with Rutland FX

NatWest Fee & Exchange Rate

Payment Fee: £15

Exchange Rate: 117.4034 The exchange rates shown for this bank are for comparative purposes only. Actual rates may vary for more information about this data please click here

4% below the mid-market rate

Cost for ₹2,000,000 INR

£17,020.27

Save up to £666.41 with Rutland FX

Santander Fee & Exchange Rate

Payment Fee: £25

Exchange Rate: 119.2379 The exchange rates shown for this bank are for comparative purposes only. Actual rates may vary for more information about this data please click here

2.5% below the mid-market rate

Cost for ₹2,000,000 INR

£16,748.19

Save up to £394.33 with Rutland FX

Lloyds Fee & Exchange Rate

Payment Fee: £9.50

Exchange Rate: 117.9538 The exchange rates shown for this bank are for comparative purposes only. Actual rates may vary for more information about this data please click here

3.55% below the mid-market rate

Cost for ₹2,000,000 INR

£16,946.29

Save up to £592.43 with Rutland FX

The table above is a currency exchange comparison to illustrate the cost in pounds for buying ₹2,000,000 Indian Rupees with Rutland FX against various high street banks to help you compare exchange rates. For more detailed information about the data shown in this table, please see our comparison information page.

How We Keep Your Money Safe

FCA Regulation

Rutland FX is a UK-based FinTech company incorporated in 2016. Rutland FX is powered by Currencycloud, a Visa subsidiary. Currencycloud is regulated by the Financial Conduct Authority (FCA) as an Electronic Money Institution (EMI) under firm reference number 900199.

Account Security

To secure your account, we implement strong customer authentication in compliance with the Payment Services Regulations 2017. We use Onfido for identity verification and fraud prevention, ensuring the authenticity of government-issued IDs.

Multi-Factor Authentication

Access to your Rutland FX account requires Two-Factor Authentication (2FA) via Authy or SMS. Outbound payments to new payees will also require Two-Factor Authentication (2FA) for added security.

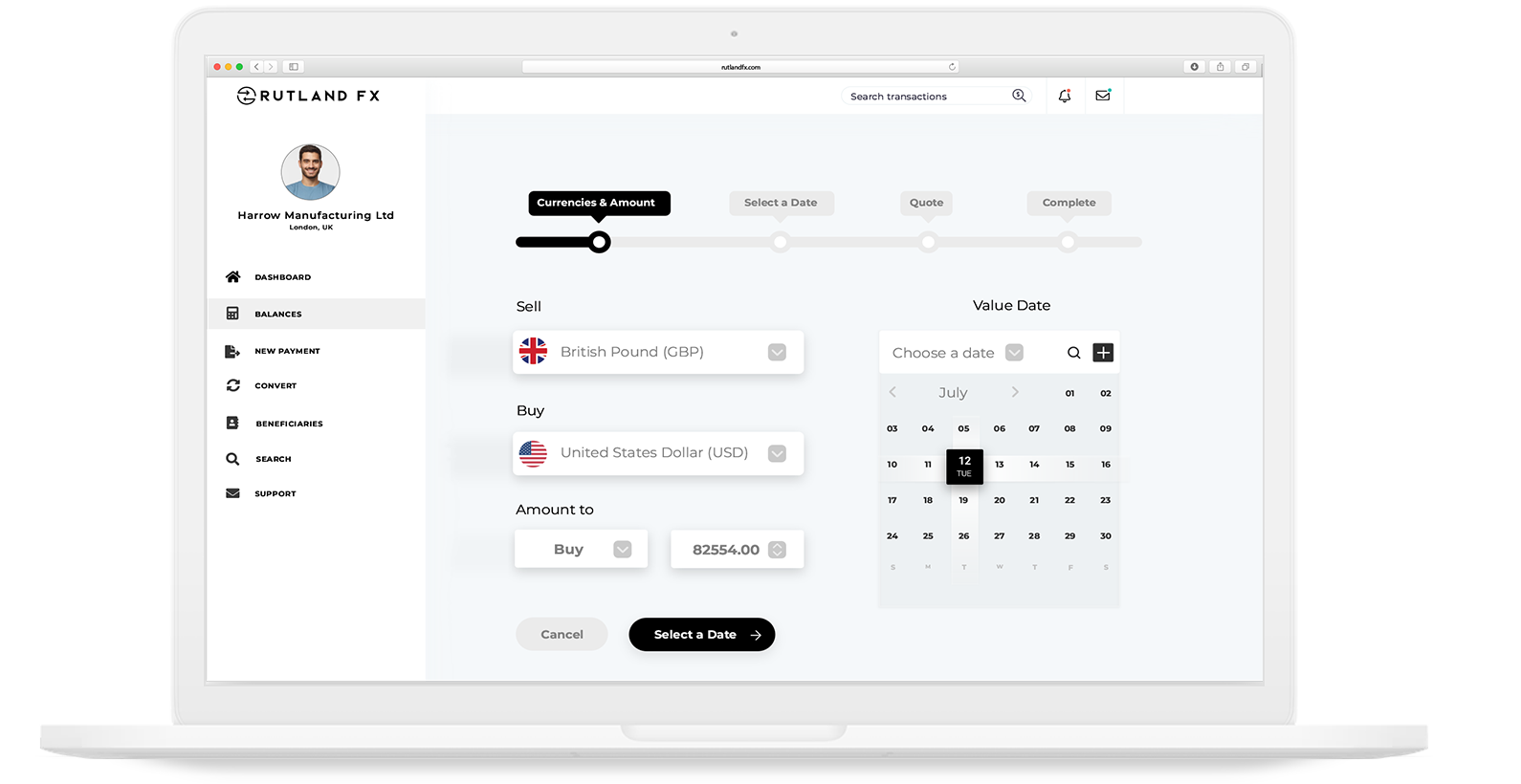

How to Send Money to India with Rutland FX?

What Details Do I Need for a Transfer to India?

To send money to India with Rutland FX, you have two options: NEFT (National Electronic Funds Transfer) or IMPS (Immediate Payment Service).

NEFT is used for payments over INR 500,000 or for banks not connected to IMPS and IMPS is used for payments up to INR 500,000.

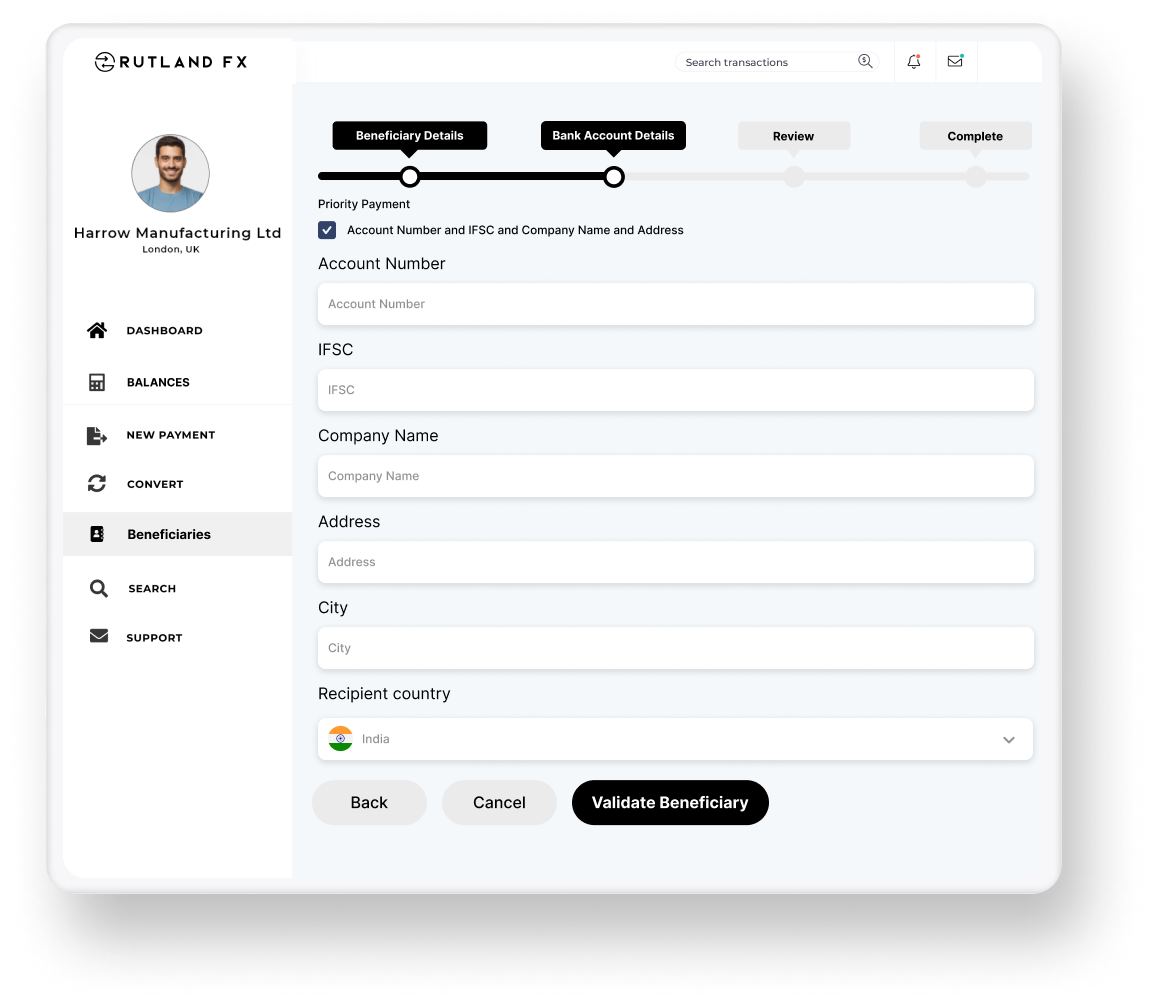

For both NEFT and IMPS payments, you will need:

- Account Number: The recipient’s unique bank account number.

- IFSC Code: The Indian Financial System Code, an 11-digit alphanumeric code that uniquely identifies the recipient’s bank branch.

- Company Name and Address: The name and address of the recipient company or individual.

- Recipient’s Name and Address: The name and address of the recipient.

You can easily validate and save these account details on the platform for future use.

What is the Fastest Way to Send Money to India?

The fastest way to send money to India with Rutland FX is via NEFT (National Electronic Funds Transfer). This method is highly efficient, ensuring quick transfer of funds, often within the same business day. NEFT transactions are processed in batches and settled multiple times throughout the day, providing a reliable payment option.

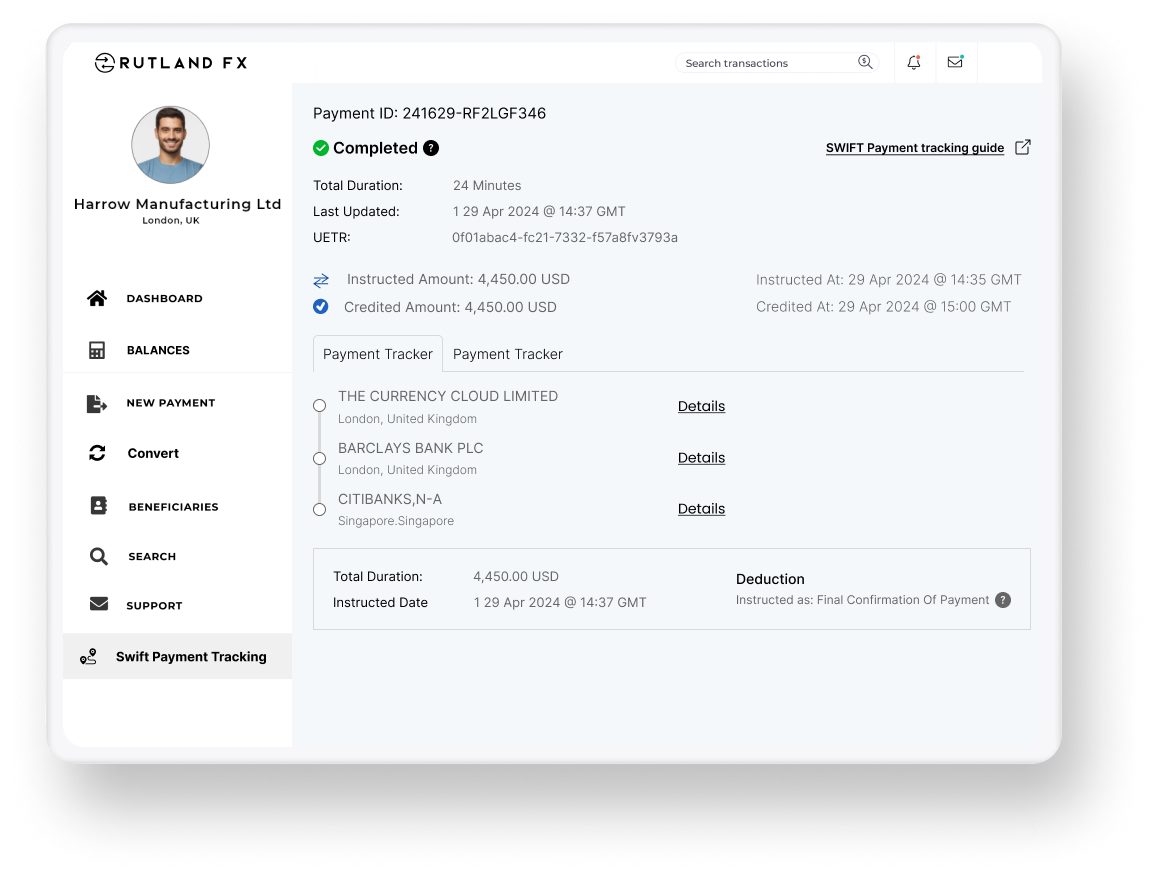

How Long Will It Take for the INR to Arrive?

The duration of international bank transfers to India depends on the payment rail and correspondent banks involved. Generally, payments sent to India with Rutland FX in INR can take 1-3 days. However, in most cases, they arrive within 24 hours.

NEFT and IMPS Transfers:

- NEFT (National Electronic Funds Transfer): Typically, NEFT transactions are processed in batches and settled multiple times throughout the day. While it can take 1-3 days for the funds to be available, most NEFT transfers are completed within 24 hours.

- IMPS (Immediate Payment Service): IMPS provides almost real-time transfer capabilities, with funds usually available instantly or within a few minutes however it can take longer depending on bank processing times.

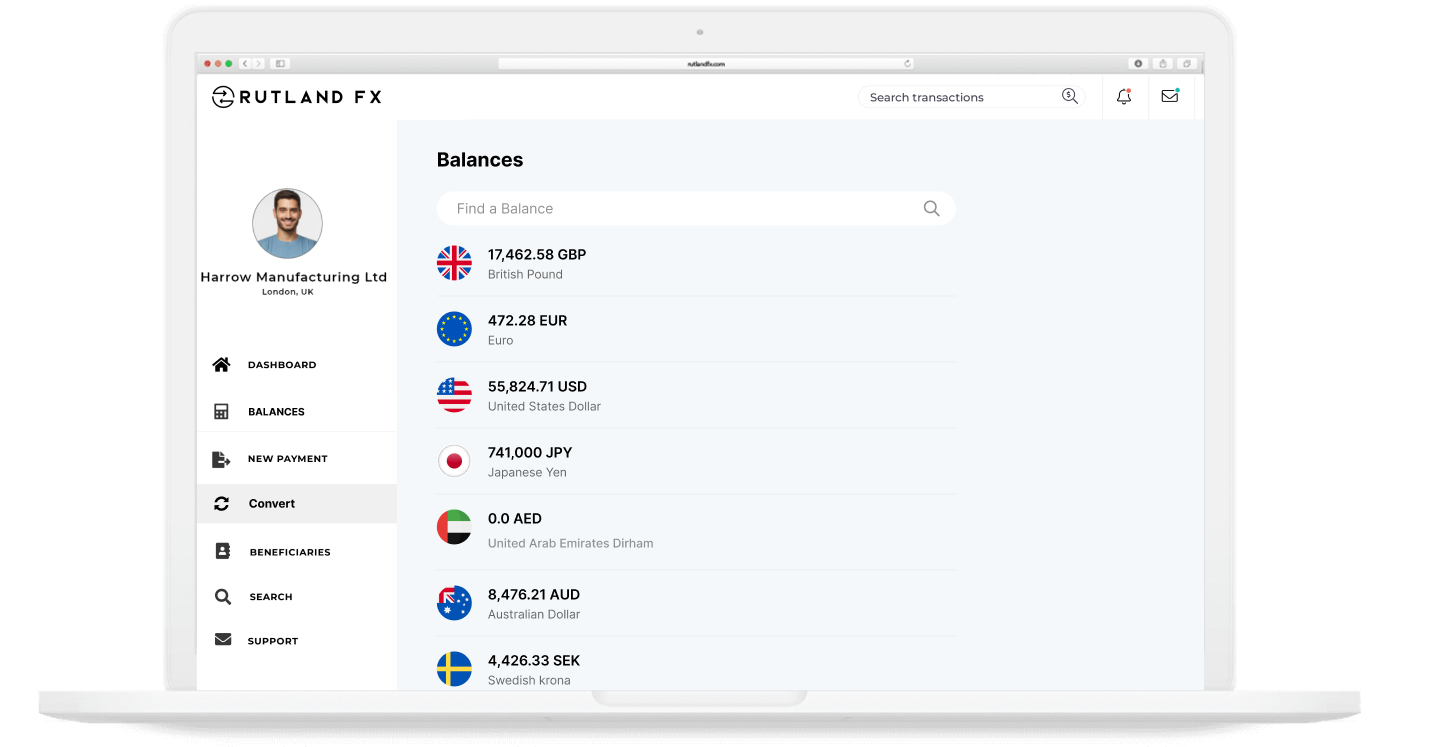

Open a UK-Based INR Account

Rutland FX offers UK-based INR multi-currency accounts to simplify managing your INR transactions. Although you can hold INR balances temporarily, you must instruct a payment in INR within a short timeframe. These accounts cannot receive funds directly from India. You can only convert INR back to GBP if a payment is returned or in certain scenarios. However, providing you with an INR account makes reconciliation easier.

Start Sending Money to India with Rutland FX

Sign Up Online

Tell us about yourself! Are you a business or a private individual? What countries do you plan to send or receive money from, what currencies do you need, and what volumes do you expect to send with Rutland FX?

Onboarding Review

Our dedicated onboarding team will review your application quickly and inform you if we need any additional information, such as an ID or a bank statement. Once that’s sorted, your account will be activated and ready to go!

Send Money Globally

You’re all set! Enjoy transferring money to over 170 countries and receiving funds in over 35 currencies from more than 120 countries, all with no payment fees and competitive exchange rates.

Ready To Get Started With Rutland FX?

Get Started

FAQs: Sending Money to India

What is an IFSC Code?

The Indian Financial System Code (IFSC) is an 11-digit alphanumeric code used to uniquely identify a specific bank branch in India. It is essential for facilitating electronic payments such as NEFT and IMPS, ensuring the funds are directed accurately to the correct bank branch.

Example of an IFSC Code: SBIN0001234

Breakdown:

- SBIN: The first four characters represent the bank code (State Bank of India in this case).

- 0: The fifth character is always zero and is reserved for future use.

- 001234: The last six characters represent the specific branch code (a particular branch of State Bank of India).

Can I Receive Funds from India?

No, although Rutland FX provides you with an INR account, it cannot be used to receive funds directly from India. You can only hold INR balances temporarily and must instruct a payment in INR within a short timeframe.

What Are the Payment Limits for Sending Money to India?

- NEFT (National Electronic Funds Transfer): For payments over INR 500,000 or for banks not connected to IMPS. You can transfer up to INR 1,500,000 per beneficiary per day, with the same limit per invoice.

- IMPS (Immediate Payment Service): For payments up to INR 500,000 per transaction.

Can I Send Funds to HDFC Bank?

Currently, we cannot make payments to HDFC Bank due to restrictions with our payment service provider.

Can I Cancel or Amend a Transfer to India After It Has Been Initiated?

You should always double-check bank details and ensure you want to dispatch a payment before sending funds internationally to avoid delays. However, there may be occasions when you need to cancel a payment. If a payment has been initiated on your account but has not yet been dispatched, you can cancel it on the platform or by contacting support.

If the payment has already been dispatched and the funds have gone to a trusted recipient, the only way to retrieve the funds is to ask the recipient to return the funds to your Rutland FX account. For example, if the funds were sent to the wrong account and you do not know the recipient, we cannot recall these funds. Therefore, always double-check all details before sending payments.

How Are My Funds Protected?

As an Electronic Money Institution (EMI), Currency Cloud is obligated to maintain adequate capital reserves and ensure the proper safeguarding of customer funds. All funds received in relation to electronic money will be safeguarded in tier-one credit institutions such as Barclays Bank PLC. This ensures that in the unlikely event of our insolvency, administrators would reimburse your funds from the safeguarded funds.

How Do I Contact Rutland FX Support?

Rutland FX offers live support via telephone and email. Email support is available 24 hours a day, and telephone support is available during UK business hours, from 8:30 AM to 5:30 PM.